When purchasing a condominium, buyers must be extra-careful. Condominiums are a form of common ownership, and come with their own set of challenges. Condominium Declarations/Bylaws and Rules and Regulations govern condo living, and must be followed to avoid fines, liens, and friction with the neighbors. Before purchasing a condominium, buyers should be diligent to make sure that they are comfortable with their purchase.

IRS will not accept paper-filings on TD F 90-22.1 (obsolete) or a printed FinCEN Form 114 (for e-filing only). If you want someone to file your FBAR on your behalf, use FinCEN Report 114a PDF, Record of Authorization to Electronically File FBARs, to authorize that person to do so. TD F 90-22.1 (Rev. January 2012) Department of the Treasury Do not use previous editions of this form REPORT OF FOREIGN BANK AND FINANCIAL ACCOUNTS Do NOT file with your Federal Tax Return OMB No. 1545-2038 1 This Report is for Calendar Year Ended 12/31 Amended Part I Filer Information 2 Type of Filer.

Pursuant to Section 22.1 of the Illinois Condominium Property Act, the seller of a condominium is required to provide certain documents to a prospective purchaser. By reviewing these documents thoroughly, buyers can avoid surprises at or after closing. For example, the Condominium Declaration/Bylaws and Rules and Regulations typically explain condominium governance, management, and items that will affect the condominium owner daily, such as rules concerning pets, noise, renting units, parking, etc. The condominium budget will lay out how much money the association collects and spends every year, and how much debt the association has. Buyers may not be interested in purchasing property that carries substantial debt for which they will have to pay special (translate: extra) assessments on a monthly or annual basis. Sellers also must provide past meeting minutes for the buyer’s review. Meeting minutes may reveal financial or maintenance issues that the association currently has or may have in the near future.

Additionally, a Section 22.1 Disclosure form is typically completed by the condominium board or the management company of a resale condominium. The form confirms the assessment, notifies prospective purchasers of any pending special assessments, states whether or not the association has any liens or lawsuits against it, and provides insurance information for the association. In most circumstances, immediately after a contract is signed, the buyer’s attorney will request a copy of the Section 22.1 Disclosure and related documents. Buyers will usually have a few days after receipt of these documents to determine whether or not they want to proceed.

If a condominium is being sold for the first time, i.e. it is either new construction or a condo conversion, the rules are slightly different. In addition to the Condominium Declaration/Bylaws, Rules and Regulations, and budget, developers must provide a drawing of the unit being purchased. If the building is large enough, the seller may also need to provide a Property Report highlighting the pros and cons of the building’s construction.

A thorough review of the documents required under Illinois law is necessary to assist buyers in making informed decisions regarding their purchase and to determine whether a particular condominium community is right for them.

The focus of this article is to provide a brief overview on the disclosures provided in Illinois by a condominium association to a prospective buyer of a unit and: (a) what is mandated by law; (b) what current practice is; (c) associations’ and board members’ exposures to claims for failure to comply; and (d) action needed to remedy the ills that exist in the market today.

In Illinois, condominium associations are governed by the Illinois Condominium Property Act (“ICPA”) while homeowner associations are governed by the Illinois Common Interest Community Association Act (“ICICAA”). Both Acts contain provisions regarding certain resale disclosure requirements to prospective purchasers of units within the association. In the ICPA, it is Section 22.1 that contains these mandates, while in the ICICAA, it is Section 1-35. For purposes of this article, since the two statutes have the same objectives and contain similar language, we will focus on Section 22.1 of the ICPA. The reader should note that the discussion in this article is focused on resale disclosures only, not original sales from developers as those latter sales are governed by different provisions within each Act.

ICPA Section 22.1

Sections 22.1 (a) and (b) of the ICPA state as follows:

Sec. 22.1. (a) In the event of any resale of a condominium unit by a unit owner other than the developer such owner shall obtain from the Board of Managers and shall make available for inspection to the prospective purchaser, upon demand, the following:

(1) A copy of the Declaration, by-laws, other condominium instruments and any rules and regulations.

(2) A statement of any liens, including a statement of the account of the unit setting forth the amounts of unpaid assessments and other charges due and owing as authorized and limited by the provisions of Section 9 of this Act or the condominium instruments.

(3) A statement of any capital expenditures anticipated by the unit owner’s association within the current or succeeding two fiscal years.

(4) A statement of the status and amount of any reserve for replacement fund and any portion of such fund earmarked for any specified project by the Board of Managers.

(5) A copy of the statement of financial condition of the unit owner’s association for the last fiscal year for which such statement is available.

(6) A statement of the status of any pending suits or judgments in which the unit owner’s association is a party.

(7) A statement setting forth what insurance coverage is provided for all unit owners by the unit owner’s association.

(8) A statement that any improvements or alterations made to the unit, or the limited common elements assigned thereto, by the prior unit owner are in good faith believed to be in compliance with the condominium instruments.

(9) The identity and mailing address of the principal office of the unit owner’s association or of the other officer or agent as is specifically designated to receive notices.

(b) The principal officer of the unit owner’s association or such other officer as is specifically designated shall furnish the above information when requested to do so in writing and within 30 days of the request.

735 ILCS 605/22.1 (a)/(b). Section 22 (including 22.1) was first proposed to the Illinois legislature on May 9, 1972. 77th Ill. Gen. Assem., House Proceedings, May 15, 1972 at 149. In introducing the bill proposing to amend the ICPA to add this section, Representative David Regner described it as a “truth in selling” provision. Id. When the bill was debated in the Senate, Senator Graham explained that the bill was directed toward providing information for the elderly and other persons on fixed incomes, so that they would be fully aware of the financial obligations associated with their purchase at the outset of purchase negotiations. (emphasis added) 77th Ill. Gen. Assem., Senate Debates, June 21, 1972, at 91. In general, the legislative history behind Section 22 and Section 22.1 show that the legislative intent was to encourage disclosure by the seller of a condominium unit for the protection of the prospective purchaser.

Some of the key elements of the statute to bear in mind as the reader continues through this article are:

- It is mandatory for a seller to obtain and make available for inspection those items set forth in the statute.

- To trigger the protections of this statute, a purchaser must demand the required disclosures of the seller.

- The association’s obligations under the statute, however, are only triggered upon the written demand of the seller (owner).

- The association is granted 30 days in which to provide the mandated disclosures.

- The statute requires that the information be furnished by an officer of the association.

The Current Reality of Section 22.1 Compliance

In today’s residential real estate practice, virtually all standard form contracts in areas with condominiums contain some provision addressing the need for a condominium unit seller to comply with the provisions of Section 22.1. Following are two versions of such provisions from form contracts commonly used at present in the Chicagoland area.

Seller shall, within five (5) Business Days from the Date of Acceptance, apply for those items of disclosure upon sale as described in the Illinois Condominium Property Act, and provide same in a timely manner, but no later than the time period provided for by law. This Contract is subject to the condition that Seller be able to procure and provide to Buyer a release or waiver of any right of first refusal or other pre-emptive rights to purchase created by the Declaration/CCRs. In the event the Condominium Association requires the personal appearance of Buyer or additional

documentation, Buyer agrees to comply with same. (Excerpt from Paragraph 15 of Multi-Board Residential Real Estate Contract 6.1) Seller shall deliver to Buyer the items stipulated by the Illinois Condominium Property Act (765 ILCS 605/1 et seq.) (“ICPA Documents”), including but not limited to the declaration, bylaws, rules and regulations, and the prior and current years’ operating budgets within ______ business days of the Acceptance Date. (Excerpt from Paragraph 10 of Chicago Association of Realtors Residential Real Estate Purchase and Sale Contract, Rev. 01/2012)

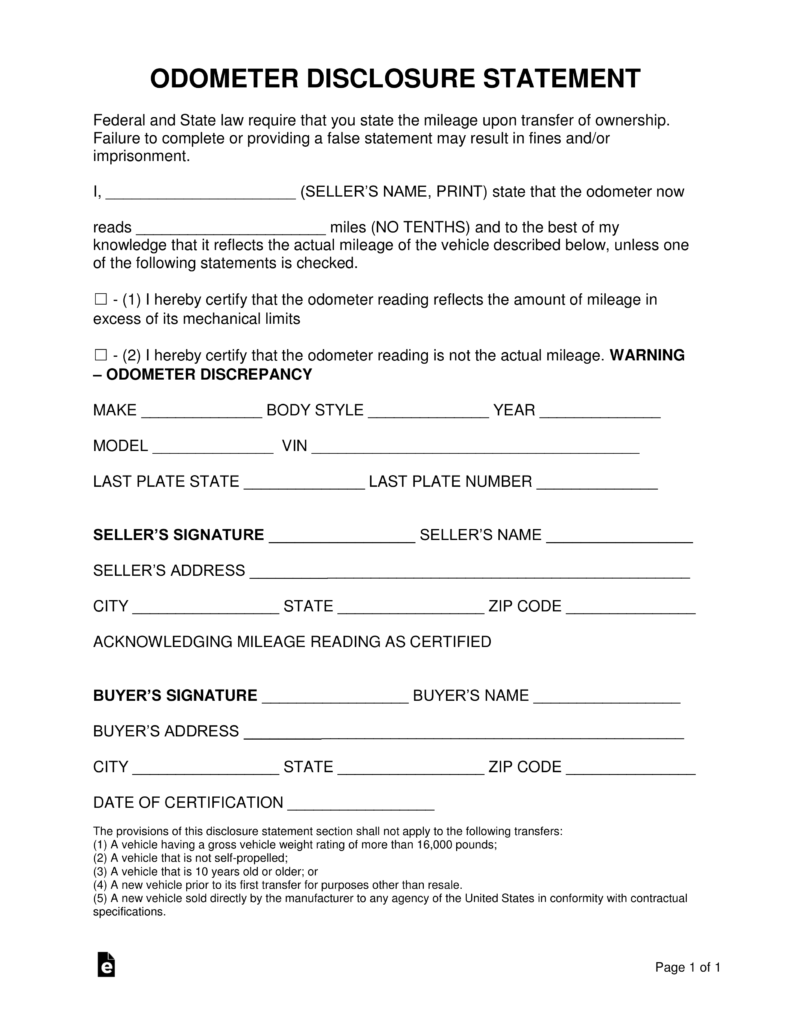

22.1 Disclosure

As the reader will quickly note, practice immediately begins to conflict with the statute in that the contracts commonly used attempt to impose a significantly reduced timeline for compliance with

the statute. Whereas the ICPA gives an association up to thirty days in which to furnish the required disclosures, sellers and purchasers consistently enter into contracts requiring the seller to furnish

that same information, which the seller must obtain from the association, within a handful of business days after the contract has been executed. 765 ILCS 605/22.1 (b).

Furthermore, it is very common for real estate brokers and others, including attorneys, involved in the residential real estate industry to be misinformed regarding practice versus reality, often

advising buyers that the Section 22.1 disclosures must be made to buyers during the attorney review period found built into residential real estate contracts. This is simply not accurate. Contracts should, and generally do, contain a separate contingency for approval of the ICPA mandated disclosures precisely because that contingency will often take weeks to satisfy, whereas attorney review contingencies should be concluded in a matter of days.

Another interesting matter of constant conflict arises in the form in which the disclosures are made. Associations, particularly larger ones, are often managed by professional property managers. Because the furnishing of these ICPA mandated disclosures involves the assumption of certain aspects of liability and associations must safeguard against providing false or inaccurate representations, associations and property managers, especially at the urging of their counsels, are constantly working to limit their exposure in responding to these resale demands. Many large

property management companies now have their own forms which they require their association clients to use and furnish when responding to 22.1 resale disclosure demands. In seeking to minimize the liability exposure of the association and/or manager, many of these forms have developed into pseudo disclosures that are circular in nature and which almost invariably fail to provide all of the information required under the statute.

One example of this conflict is the following, taken from a professional property manager’s preprinted 22.1 disclosure form submitted to a client of our firm, who was purchasing a condominium unit in Chicago last year:

1. Are there any liens against the Association? If yes, please give details concerning all such liens.

A: Not to our knowledge, however, we have not ordered a search.

In the foregoing example, when comparing the form’s preprinted question, it would appear that the disclosure form is attempting to comply with Section 22.1(a)(2), which calls for a statement disclosing any liens. The problem lies in the fact that the question is completely off target in that Section 22.1(a)(2) is not directed towards liens “against the Association”. 765 ILCS 605/22.1

(a)(2). Instead, it calls for “a statement of the account of the unit setting forth the amounts of unpaid assessments and other charges due and owing as authorized…by the provisions of Section 9 of this Act…” Providing information regarding liens against the Association does nothing to comply with Section 22.1(a)(2).

From the same disclosure form, consider the following example:

5. Any Improvements or alterations in the above referenced Unit or in the limited common elements assigned to the Unit by the current and any prior owners are in good faith believed to be in compliance with the Condominium Declaration. If not, please specify those items not in compliance with the Condominium Declaration.

A: We have not inspected the premises.

This question and answer excerpt clearly is directed at satisfying the mandate of Section 22.1(a)(8). However, it is questionable whether the answer provided by the association in the above example

even serves as a disclosure of any kind. The purpose of Section 22.1 is to provide a prospective purchaser with full financial information before they purchase a unit. The legislature, acknowledging that the association should have and supply the necessary information to allow a prospective purchaser in making a fully informed decision, did not carve out exceptions for failure to inspect the premises. Rather, the legislature specifically included the words “in good faith” in Section 22.1(a)(8). The Association is supposed to make and provide an affirmative statement that, in good faith, it believes that any improvements or alterations in the unit were made in compliance with the Declaration. At minimum, to truly comply with the intent and mandate of this section, the association should be required to state that it is not aware of any improvements or alterations having been made in the unit. That is at least a statement upon which the purchaser can rely in making a decision. To suggest that the answer provided by the association in the foregoing example is a good faith compliance with Section 22.1(a)(8) is to completely gut the protections established by the statute.

Dealing with the same Section 22.1(a)(8), consider the following response provided on a different manager’s form for another Chicago condominium purchase:

22.1 Disclosure Form Illinois Free

(8) A statement that any improvements or alterations made to this unit, or the limited common elements assigned thereto, by the prior unit owner are in good faith believed to be in compliance with the condominium instruments.

A: The Association does not inspect individual apartments and takes no responsibility for improvements or alterations made by individual unit owners within individual units or to limited common elements. The Association has no knowledge of any improvements or alterations made by the unit owner to the subject unit (or to the limited common elements that serve that unit) that are not in compliance with the Association’s Declaration and rules.

Here, the association has at least made an affirmative statement by including the second sentence. But, upon scrutiny, it is hard to support the notion that the association is truly making this

disclosure in good faith. By including limited common elements in the first sentence, the association, in this author’s opinion, belies any good faith. Limited common elements are owned by the association, not the unit owner. Therefore, should it not be incumbent upon the association, in making these disclosures, to actually determine that no improvements or alterations have been made to the limited common elements or that any improvements or alterations thereto are in compliance?

Continuing with the disclosure form cited in the first two examples, above, we find the following disclosure which purports to be provided in satisfaction of Section 22.1(a)(5):

7. A copy of the latest financial statement, operating budget and Board meeting minutes showing any possible anticipated capital expenditures and/or approval of special assessments, if applicable, should be requested from the seller.

Talk about being circular! This disclosure does not even bother to pose a question and present an answer. Rather, it simply restates portions of the relevant statute and directs the intended recipient, the purchaser, to request the documentation from the seller. This flies in the face of Section 22.1(b) which, as previously noted, expressly states that an “officer of the unit owner’s association… shall furnish the above information when requested to do so.” 765 ILCS 605/22.1(b).

One last example – see the following disclosure provided in connection with the mandates of Section 22.1(a)(5):

(5) A copy of the statement of financial condition of the unit owner’s association for the last fiscal year for which such statement is available.

22.1 Disclosure Form Pdf Template

A: A copy of the Annual Budget may be ordered from the HomeWiseDocs website.

While Section 22.1 does only require that the association “shall make available” the copies called for in subsection (a)(5), is that obligation satisfied when the access referenced on the referenced website requires payment and, as is not uncommon, the seller turns around and tells the purchaser to log into the website and pay the requisite fees? Fighting this common practice is like tilting at the windmills and buyer’s attorneys have little choice in these cases but to tell their clients to play along and go with the flow. But this shifting of the burden and liability under the statute is detrimental to purchasers and severely undermines the intent behind the enactment of Section 22.1.

Lender’s Questionnaires

Oddly enough, concurrent with a steady erosion of compliance with Section 22.1, there has been a growing, and equally concerning expansion of association exposure to liability through responding to lender’s condominium association questionnaires. Almost invariably, when a purchaser applies for a loan for the purchase of a condominium unit, the lender sends the association its own questionnaire, which the lender must get back and have approved by the lender’s underwriter before the purchaser’s financing can be approved. These questionnaires commonly mimic many of the questions posed by Section 22.1 but also go well beyond the scope of that statute. Typical questions asked in these questionnaires include the following (taken from the USBHM Established Condominium Project Underwriting Questionnaire, Revision 02.11.2015):

- Does at least 10% of the budget provide for funding of replacement reserves, capital expenditures, deferred maintenance, and insurance deductibles?

- Number of units over 60 days delinquent in payment of HOA dues or assessments (including REO owned units).

- Do the project documents include any restrictions on sale which would limit the free

transferability of title? - Are the recreational amenities or common elements leased?

- Does the association have any knowledge of any adverse environmental factors affecting the project as a whole or as individual units?

- Does the property management company (if applicable) have the authority to draw checks against or transfer from the reserve account?

- Are two or more members of the Board of Directors required to sign checks drafted against the reserve account?

There is no statute requiring an association to provide the above information. In the event that an association were to elect to not provide the requested answers, it is almost certain that the

prospective purchaser’s financing would be declined. Since most, if not all, conventional lenders have some form of condominium questionnaire similar to the one cited above, refusal of an association to respond to the questionnaire would mean that an owner would be limited to selling to a purchaser buying with cash or unconventional financing, severely reducing the available pool of purchasers and likely significantly suppressing the purchase price. For this reason, despite being adverse to providing information strictly compliant with Section 22.1, associations regularly provide answers to the lenders’ questionnaires, even though doing so vastly expands the potential for liability for having provided bad information.

Enforcement Rights in the Event of Non-Compliance

Unfortunately, Section 22.1 does not contain specific enforcement rights or remedies in the event of a breach of seller or association obligations under the statute. A prospective buyer, of course, can rely on contractual rights contained in their purchase contract prior to closing on the unit purchase, should the seller fail to provide the requisite disclosures upon demand. But dealing with evasive, erroneous, misleading, or even fraudulent disclosures can be significantly more difficult for a buyer, particularly because they generally will not find out that the disclosures were such until after they have closed on their purchase. And by then, the economics of the situation very often are such that they simply move on and bear the brunt of the misrepresentations because taking legal action is too risky when the legal fees would significantly outweigh the damages sustained as a result of the defective disclosures.

But a small number of cases have been litigated in Illinois and serve as critical precedent in this arena. One such case is Mikulecky v. Bart, 355 Ill. App. 3d 1006 (2004), which addressed Section

22.1(a)(3). The reader will recall that this section of the statute calls for a statement regarding any anticipated capital expenditures in the current and succeeding two years. In Mikulecky, the purchaser received disclosures that only set out known (approved) capital expenditures but omitted information regarding various capital expenditures that had been discussed and planned, but not yet finalized or confirmed. 355 Ill. App. 3d at 1008. Shortly after closing on her purchase, the plaintiff discovered that those anticipated expenditures were going to cost her over $10,000 in additional special assessments. Id.

On appeal, the court reversed a trial court ruling in favor of the association and held that “disclosure of information [by sellers] in furtherance of the public policy of Illinois” was the driving legislative mandate behind the statute. 355 Ill. App. 3d at 1012. More specifically, the appellate court ruled that the word “anticipated” must be defined in this context by giving “effect to the plain and ordinary meaning of the language without resort to other tools of statutory construction.” Id. at 1013. In doing so, the court rejected the seller’s argument that it had satisfied its obligations under the statute by simply disclosing those capital expenditures which had been approved, despite the fact that the seller and the association knew that other major capital expenditures had been discussed and likely would be undertaken by the association in the near future. Id.

Another recent Illinois case (D’Attomo v. Baubeck, 2015 IL App (2d) 140865) shed light upon, and confirmed the existence of, post-closing remedies available to purchasers who have been provided with less than complete disclosures pursuant to Section 22.1. In D’Attomo, the purchaser had been provided with a copy of the original Declarations and Bylaws of the association, but not of an amendment that had been passed prior to his purchase. 2015 IL App (2d) 140865 at 7. The trial court, as in the Mikulecky case, ruled in favor of the association and the seller. Id. at 16. Significant portions of that ruling (for procedural reasons, only as to the seller) were reversed on appeal. Id. at 76. The appellate court, after expressly noting that “Section 22.1 is silent with respect to any remedy for the violation of the disclosure obligations” (Id. at 35), held that said silence is not to be interpreted as precluding a purchaser’s private cause of action under that statute and, citing to Mikulecky and legislative intent, further ruled that an implied private right of action in favor of the purchaser, post-closing, did exist under Section 22.1 in light of the facts presented. Id. at 39.

Conclusion

In the opinion of this author, legislative action needs to be taken to stop the use of evasive responses that have become so commonplace in the condominium resale market when providing

Section 22.1 disclosures. Steps need to be taken to clarify and codify the intent of the statute and to incorporate the key elements of the Mikulecky and D’Attomo cases into the statutory provisions. The legislature should also revise the statute to provide for specific remedies for misleading or erroneous disclosures. Barring such intervention, it is unlikely that the abuses often being exercised so flagrantly by associations and property management companies will be stemmed because the economics of a legal battle by individual purchasers to challenge those abuses is virtually always going to be cost-prohibitive. Until and unless these changes are made, condominium purchasers should exercise caution in relying exclusively on the intended protections of Section 22.1 and should attempt to dig deeper into the association records and require the seller to provide direct answers to specific questions – something that can be quite impractical in a seller’s market.

Our firm represents many condominium associations throughout the Chicagoland area, as well as sellers and purchasers of condominium units. We understand that associations and their counsels may resist the changes suggested by this article. We likewise understand the position of sellers who don’t want to absorb any more liability than necessary in responding to purchaser’s inquiries. But, when viewed in light of what is most equitable and when factoring in the significant impact that major undisclosed special assessments can have on a new owner, it benefits nobody to support continued lack of transparency and wordsmithing in this context. In the end, there can be as much harm to the association when an owner struggles to meet his or her financial obligations as a result of being caught by surprise by anticipated, but undisclosed repairs and capital expenditures. Nor is it beneficial to welcome an owner into the community on such negative terms. After all, as emphasized throughout this article and in the caselaw, transparency and focus on protection of the purchaser was the underlying impetus when our legislature promulgated Section 22.1 in the first place.

22.1 Disclosure

Written By: James A. Erwin, Principal

Contributing Author: Michelle Craig, Law Clerk